So far this year, close to 20% of scooter registrations pan-India has been electric, and close to 25% of 3Ws sales have been electric.

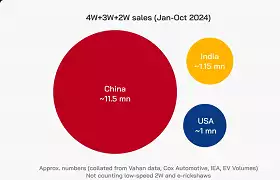

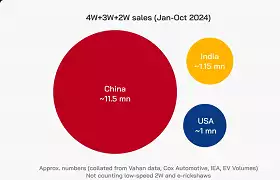

So far this year, close to 20% of scooter registrations pan-India has been electric, and close to 25% of 3Ws sales have been electric.Many people still don’t realise the scale of EVs in India. This is in large part because cars dominate the electric vehicle debate, even though the vast majority of the population doesn’t own a car. When you look at two-wheelers and three-wheelers, adoption is surging, to the point that India is essentially the biggest market outside of China in terms of volumes.

When potential investors outside the country hear about penetration and sales in commercial vehicles and scooters here, they usually struggle to believe it initially.

So far this year, close to 20% of scooter registrations pan-India has been electric, and close to 25% of 3Ws sales have been electric.

These are wild numbers compared to global adoption figures.

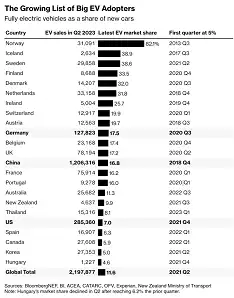

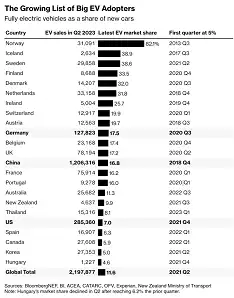

The other countries with high EV adoption are China (huge economy, huge government push) and small markets like Norway, where there’s extremely high penetration but annual sales are only about 0.1 million, less than 1/10th of India’s (all the Nordic countries put together are about 0.4 million in annual sales).

Barring China and these outliers, India is the place for EVs. And this is before counting e-rickshaws and low-speed two-wheelers (e.g. Yulu bikes, which don’t need to be registered and have a maximum speed of 25 kmph).

Scooters plus three-wheelers (excluding e-rickshaws) account for >25% of all vehicles in India. If you include e-rickshaws and low-speed two-wheelers, it’s more like 30%. This is how India moves, and EVs are already becoming mainstream in these segments.

Electric three-wheeler registrations are up 1.85x so far this year, while electric scooter registrations are up 1.25x.

We also often don’t think about the emissions impact of, say, an auto-rickshaw, but the average rickshaw emits about 5 tonnes of CO2 a year, versus 2.5-3 tonnes for a petrol car. Cars emit a lot more per km, but rickshaws travel many more kilometres than the average private car in India. (These emissions are ballpark estimates, assuming 45,000 km a year for a rickshaw and 15,000 km a year for a personal car. The numbers can vary widely)

We like cars as much as anyone else, but that’s not where you should look for the India EV story. There are huge markets still out there in bikes, buses, and LCVs (light commercial vehicles). The cost and convenience advantages of EVs are not just for rich countries. When you talk about an electric transition and cutting emissions, India is a big deal. And that’s thanks to both an entire ecosystem that has believed in EVs and some serious support from the government.

The point is that building in India, for India, is a way bigger opportunity than a lot of people—both outside and inside—realise.