To protect market share and meet planned targets, companies continue producing based on monthly forecasts.

To protect market share and meet planned targets, companies continue producing based on monthly forecasts.Indian auto dealerships are facing significant challenges as a recent decline in car sales in India has left them burdened with a substantial inventory surplus—equivalent to approximately 85 days of sales. Despite receiving clear signals of slowing demand, many OEMs, driven by pressure to maintain full capacity utilisation, continued production at maximum levels. This is not the first time this situation of excess auto inventory has happened. This has happened several times in the past and has been reported in newspapers many times. This chronic situation underscores broader inefficiencies in the industry's inventory management.

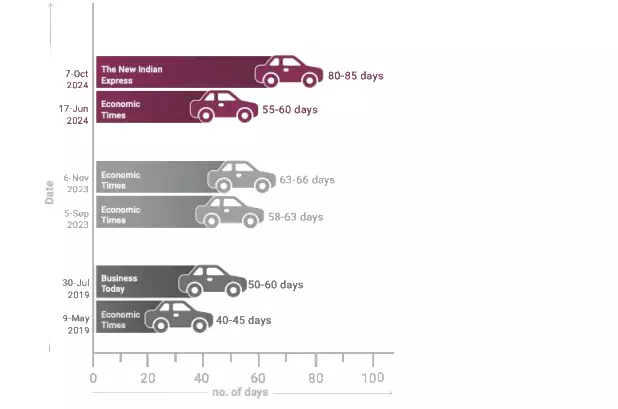

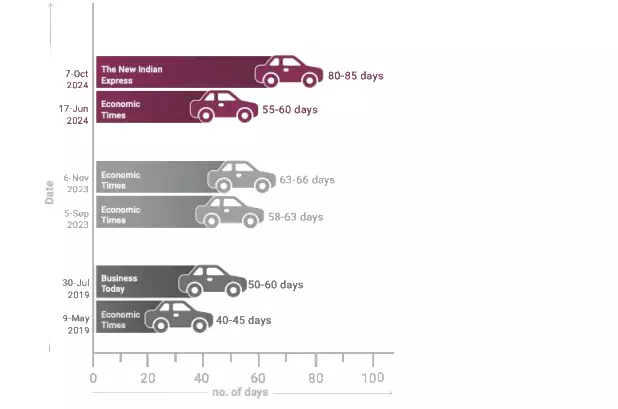

Figure 1: Few newspaper reports on excess inventory over the last 6 years. Source: Various

Figure 1: Few newspaper reports on excess inventory over the last 6 years. Source: VariousIn this article, we examine the root causes behind the surge in auto inventory levels with dealerships and explore strategies that companies can implement to align production with demand more effectively. This ensures a more efficient and win-win inventory management for the company and dealerships while also ensuring that supplier partners are not negatively impacted.

Let’s first explore why this situation happens.

The genesis of the inventory crisis

Inventory issues at dealerships stem from two key factors. First, companies set annual targets, which are then broken down into monthly goals for regional sales teams. The sales force is expected to meet these targets consistently. Further, these targets also drive manufacturing forecasts and production plans, as companies aim to meet internal projections. Second, to show achievement of market share, either maintained or gained, as reported by industry bodies like SIAM based on wholesale data, it is essential for companies to show strong primary sales performance.

To protect market share and meet planned targets, companies continue producing based on monthly forecasts. However, these forecasts are often inaccurate, leading to inventory misalignment between what’s made and actual retail demand. Nevertheless, to achieve primary targets, companies push available stock to dealerships, which may not match dealership needs. This results in a disconnect between what dealerships hold and what customers are seeking. For instance, despite having 85 days' worth of inventory, customers may still struggle to find the specific models, colours or configurations they want, leading to excess stock.

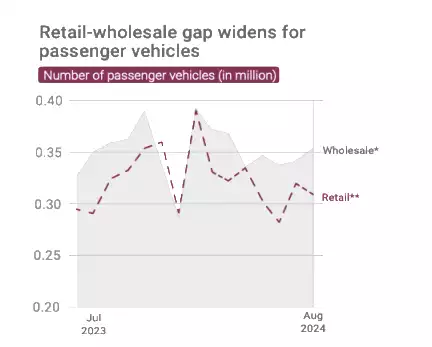

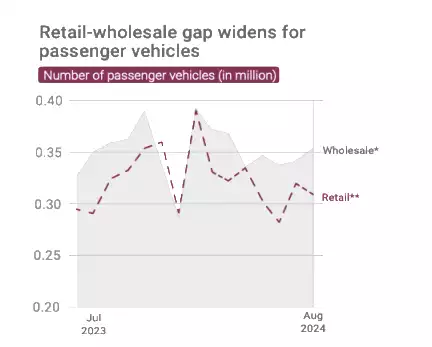

The cumulative effect of target-driven inventory push and the need to protect primary numbers is evidenced in the widening gap between retailand wholesale sales data.

*Vehicles dispatched from factories to dealerships **Vehicles sold at dealerships Figure 2: Retail- wholesale gap in passenger vehicles. Source: FADA

*Vehicles dispatched from factories to dealerships **Vehicles sold at dealerships Figure 2: Retail- wholesale gap in passenger vehicles. Source: FADA To make matters worse, pushing auto inventory into dealerships in this manner delays real market feedback for the company, as the production and procurement departments don’t have visibility into actual demand trends. They only have visibility of internal forecasts and are unaware of changing market preferences. While there are indications that the market is slowing down, demand is shifting, and different SKUs are required, this information is not reflected in the internal MIS of OEM plants or their suppliers.

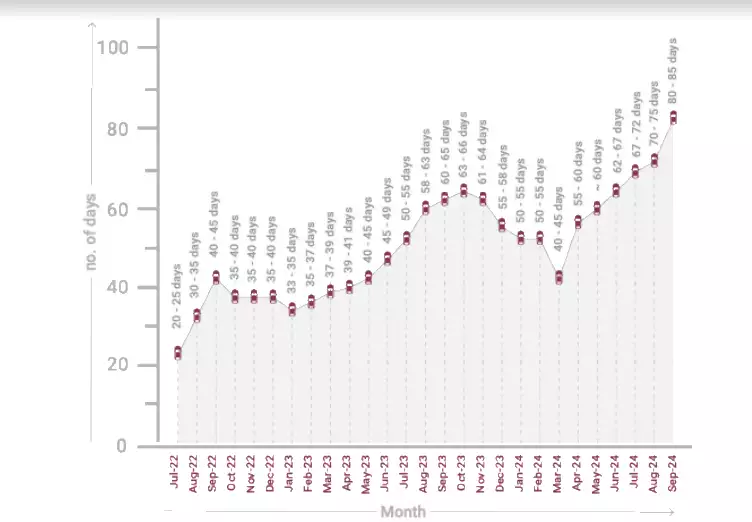

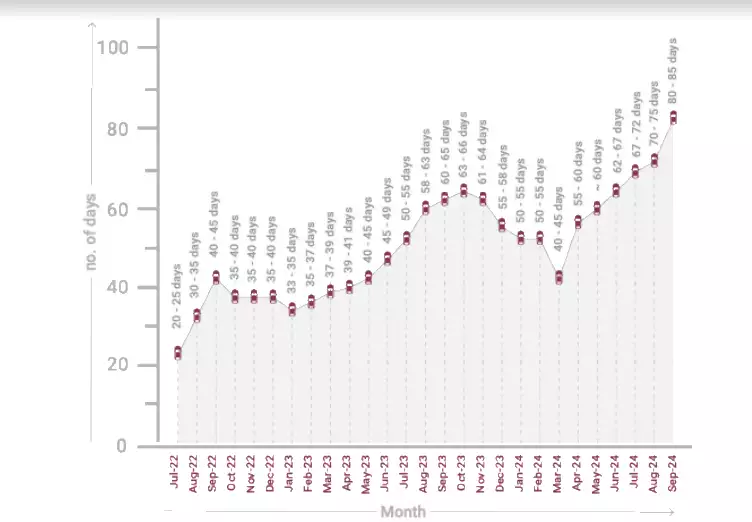

The current issue did not emerge in just one month; it may have started several months ago. This is a cumulative effect—small amounts of inventory gradually built up, increasing from manageable levels of 20 to 30 days to the current 80-85 days. At this stage, dealers are facing significant strain, with a large portion of their working capital tied up in excess stock. In addition, they face inevitable margin losses as this excess stock can only be cleared through heavy discounting.

Figure 3: Inventory data levels at passenger car dealerships from July 2022 – Oct 2024. Source: FADA and several news reports

Figure 3: Inventory data levels at passenger car dealerships from July 2022 – Oct 2024. Source: FADA and several news reports This operational pressure has sparked protests from dealerships and fueled an ongoing debate in the auto industry about whether wholesale or retail sales numbers truly indicate the industry’s health. Several leading auto manufacturers have argued in the past that actual car sales to customers better reflect consumer sentiment and have urged the industry to shift toward reporting retail numbers. However, the implementation of this paradigm has remained elusive.

Supply chain impact of this crisis

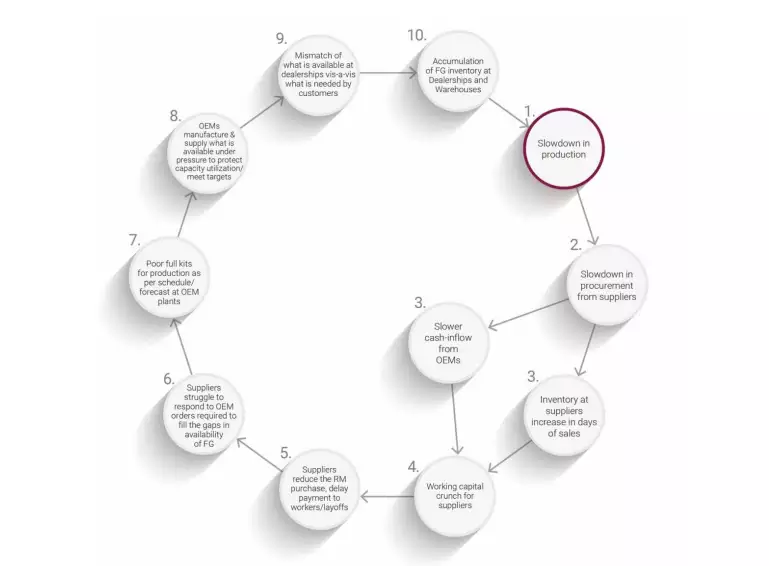

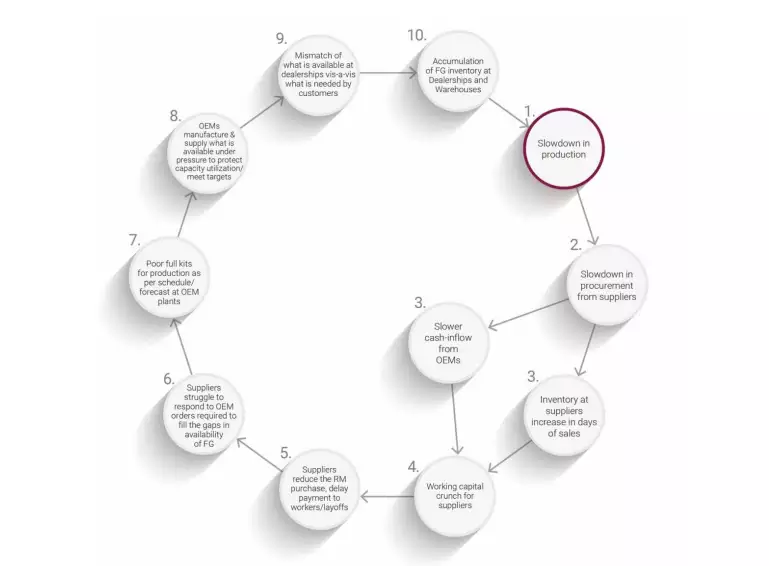

The situation at dealerships has now reached a point where companies are being forced to scale back production to prevent further accumulation. However, halting production now will not be an easy decision for OEMs since it could create a significant disruption (not just for their primary targets) in the supply chain. When OEMs cut production, suppliers would bear the brunt of the bullwhip effect caused by this decision.

Figure 4: Inventory with suppliers for FY23iv. Source: CMIE database

Figure 4: Inventory with suppliers for FY23iv. Source: CMIE database Suppliers are already burdened with significant inventory, holding more than a month's worth despite often being just a couple of days apart from the OEMs they serve. If OEM production reduces, inventories across suppliers (finished goods, work in progress, and raw materials) will accumulate, potentially doubling or tripling the number of days, forcing them to cut their production as well. Meanwhile, with reduced offtake, payments from OEMs may slow or cease, leading to liquidity issues. Suppliers, some of whom may even have invested in additional capacity with borrowed capital during the rise in OEM demand, will now struggle to cover interest payments and other expenses. Many suppliers will cut back on purchases and may be forced to lay off workers. The disruption to their working capital cycle will make material procurement more difficult, creating a vicious cycle of reduced production and limited cash flow.

Figure 5: The vicious loop that will be created by OEM slowdown.

Figure 5: The vicious loop that will be created by OEM slowdown. Even during a slowdown, while an OEM may have FG inventory in its supply chain, it might not align with specific customer demands. This mismatch could still necessitate OEMs to continue production and procurement to fulfill those needs despite existing stock. However, strained working capital would limit suppliers' ability to meet this demand, with some even defaulting. This would further dampen OEM's sales.

When demand returns and OEMs eventually try to ramp up production, suppliers may still struggle to respond quickly due to the limitation of the workforce and shortage of working capital. Since OEMs depend on all component suppliers ramping up in unison to increase vehicle production, they, too, will suffer until the last supplier is able to recover fully, resulting in a lose-lose situation for both parties.

What should be done going forward so that the situation does not arise?

Peg Market Share / Internal Targets to Retail Numbers:

As some leading OEMs have emphasised, all manufacturers must recognise what Eliyahu Goldratt said “until the end consumer has bought the vehicle, no one in the supply chain has truly made a sale”. Basing performance metrics on wholesale figures is misleading and leads to inflated production and artificial demand projections. Instead, market share and internal targets should be pegged to retail sales. The sales team, too, must shift their efforts from pushing inventory down the dealerships to focusing more on tactics to create demand and drive actual purchases.

Second, to sustainably address the excess auto inventory problem at dealerships and throughout the supply chain to suppliers, the forecast-based approach to inventory creation and movement must be abandoned. Instead, a systematic approach grounded in consumption signals from the market is essential. This method will better align the supply chain with actual market demand by reducing the lag in reaction by OEMs and suppliers to actual demand signals.

The solution involves:

Defining inventory limits:

Defining maximum auto inventory limits involves setting a top limit for inventory at each location (dealer as well as company warehouses) for each SKU and halting additional shipments once this limit is breached. By doing so, the company can quickly identify and address problems related to demand or market conditions before they escalate.

Setting maximum inventory levels at various stocking locations—such as dealers and yards for finished goods and plants for components—while prioritising production and logistics based on the risk of stock-outs ensures availability across all these locations. At the same time, halting manufacturing or procurement when these limits are reached for each SKU helps prevent overstocking in the supply chain and ensures production aligns with actual demand. Dynamically adjusting inventory limits in response to changing demand patterns over time ensures continued alignment with current demand.

Supplier alignment:

To enhance responsiveness across the supply chain, it is crucial to provide suppliers with visibility into the OEMs' component buffers. By sharing real-time signals about component stock levels along with a risk-of-stock-out-based priority system, suppliers can proactively adjust their production schedules and supply in response to changes in OEM’s production.

Since the OEM plant serves as an aggregation point, the sales fluctuations across dealers nationwide tend to average out, resulting in a fairly consistent load on the OEM plant for any SKU on a daily basis. This smooths out demand spikes, thereby reducing the need for suppliers to carry excessive protective inventory, which is often required in a forecast based system.

If market demand slows and the offtake of finished goods from OEMs decreases, there will be a corresponding drop in parts consumption. Since they have visibility to this, suppliers will be able to take preemptive steps to adjust their production plans 6-8 months in advance, rather than relying on the current forecast-driven inventory management system. While suppliers can accommodate occasional dips in demand, they are wary of prolonged or severe downturns. Thus, this proactive approach will help mitigate the bullwhip effect during market fluctuations, fostering healthier vendor relationships and creating a more agile supply chain.

Optimising the use of dealer working capital:

By having a defined upper limit for each SKU, dealers’ working capital is not locked into specific items but remains available for a broader range of color and model variants. This allows dealers to stock a variety of items, enhancing their ability to fulfill diverse customer needs and improving delivery times, thus reducing customer wait times for less common items and meeting overall market demand more effectively.

Certain OEMs are already exploring models that minimise inventory at dealerships. For instance, a leading luxury auto OEM has implemented a zero inventory at dealership model called ‘Retail of the Future’v, allowing customers to purchase directly from the company. This shift eliminates dealer inventory, enabling them to reduce their financial risks and focus on customer relationships rather than managing inventory.

What to do to mitigate the immediate crisis?

While these strategies provide long-term solutions, OEMs must address the immediate crisis by making difficult decisions regarding reduced production, particularly if car sales in India decline during the Diwali season. However, as there are mismatches in inventory at dealerships vis-à-vis customer demand, OEMs still need to produce to cover the gaps in FG availability. To protect their sales, however limited they may be, OEMs need to ensure that suppliers are able to continue to supply parts despite having a working capital crunch. In order to maintain the continuity of business, suppliers need to pay for raw materials as well as labour. Given their tight working capital and high receivables situation, their business continuity could be seriously jeopardised.

Hence, it is in the interest of larger and more financially stable auto OEMs to facilitate a robust win-win-win ‘bill discounting’ mechanism with the help of a financial institution by

leveraging its own high credit rating. This will help the suppliers get paid faster without draining OEMs’ cash.

However, as mentioned, this is not a long-term solution. The few strategic steps discussed in this article must be taken to sustainably address the challenges faced by OEMs, their supply chain partners, and dealerships.

A final word

By adopting strategies that emphasise end-to-end flexibility and agility, auto supply chains can meet customer demands without increasing inventory levels, fostering a healthier relationship among all stakeholders in the supply chain. By doing so, the Indian auto sector can establish a compelling narrative for itself. While other markets may emphasise technology, quality, or value for money, India's narrative should center on providing flexibility and reducing lead times to enhance customer satisfaction. This alignment with market needs will better position companies to effectively respond to evolving consumer preferences and demands, ultimately fostering long-term resilience and competitiveness in the market.

i Website links for sources: https://economictimes.indiatimes.com/industry/auto/auto-news/vehicle-dealers-see-

inventory-pileup-as-sales-continue-to-dip/articleshow/69241408.cms?from=mdr;

https://www.businesstoday.in/industry/banks/story/sbi-tightens-lending-terms-for-auto-dealers-as-car-sales-

slump-216111-2019-07-30; https://economictimes.indiatimes.com/industry/auto/auto-news/auto-retail-sales-

surge-9-in-aug/articleshow/103406142.cms?from=mdr;

https://economictimes.indiatimes.com/industry/auto/indias-october-auto-sales-rise-12-5-on-month-navratri-sees-

record-breaking-sales/articleshow/104998644.cms?from=mdr;

https://economictimes.indiatimes.com/industry/auto/auto-news/car-dealers-feel-the-load-as-sales-slow-

inventory-piles-up/articleshow/111042997.cms?from=mdr;

https://www.newindianexpress.com/business/2024/Sep/05/unsold-passenger-vehicle-inventory-rises-to-78-lakh-

units-valued-at-rs-77800-crore-fada#

ii Wholesales refer to the dispatch of vehicles from a factory to a dealership. Dealers pay for the stock upfront,

regardless of whether the vehicles are sold in the showroom. Retail sales, on the other hand, reflect actual sales to

customers and are determined using vehicle registration data from the government's VAHAN website.

iii https://economictimes.indiatimes.com/industry/auto/auto-news/auto-sector-what-the-numbers-dont-

tell/articleshow/71883855.cms?from=mdr

iv Days Sales of Inventory (DSI)= Average Inventory/(COGS/365), where Average Inventory = (opening + closing

stock)

v https://auto.economictimes.indiatimes.com/news/aftermarket/mercedes-benz-rolls-out-direct-to-customer-

retail-sales-model-in-india/87203610

(Disclaimer: Ravindra Patki is Partner at Vector Consulting Group. Views are personal.)