"This sustained demand for premium vehicles comes despite minimal discounting, suggesting a resilient luxury segment unfazed by broader market pressures."

"This sustained demand for premium vehicles comes despite minimal discounting, suggesting a resilient luxury segment unfazed by broader market pressures."The passenger vehicle market is witnessing a paradox this festive season: some models command waiting periods of up to 96 weeks with no discounts while others are offering cash discounts as high as INR 4.5 lakh to manage inventory pileups. This highlights a growing segmentation between premium and volume players in one of the world's largest auto markets even as most PV dealers report a 10% month-on-month sales growth in October after a relatively slow start in the festive season.

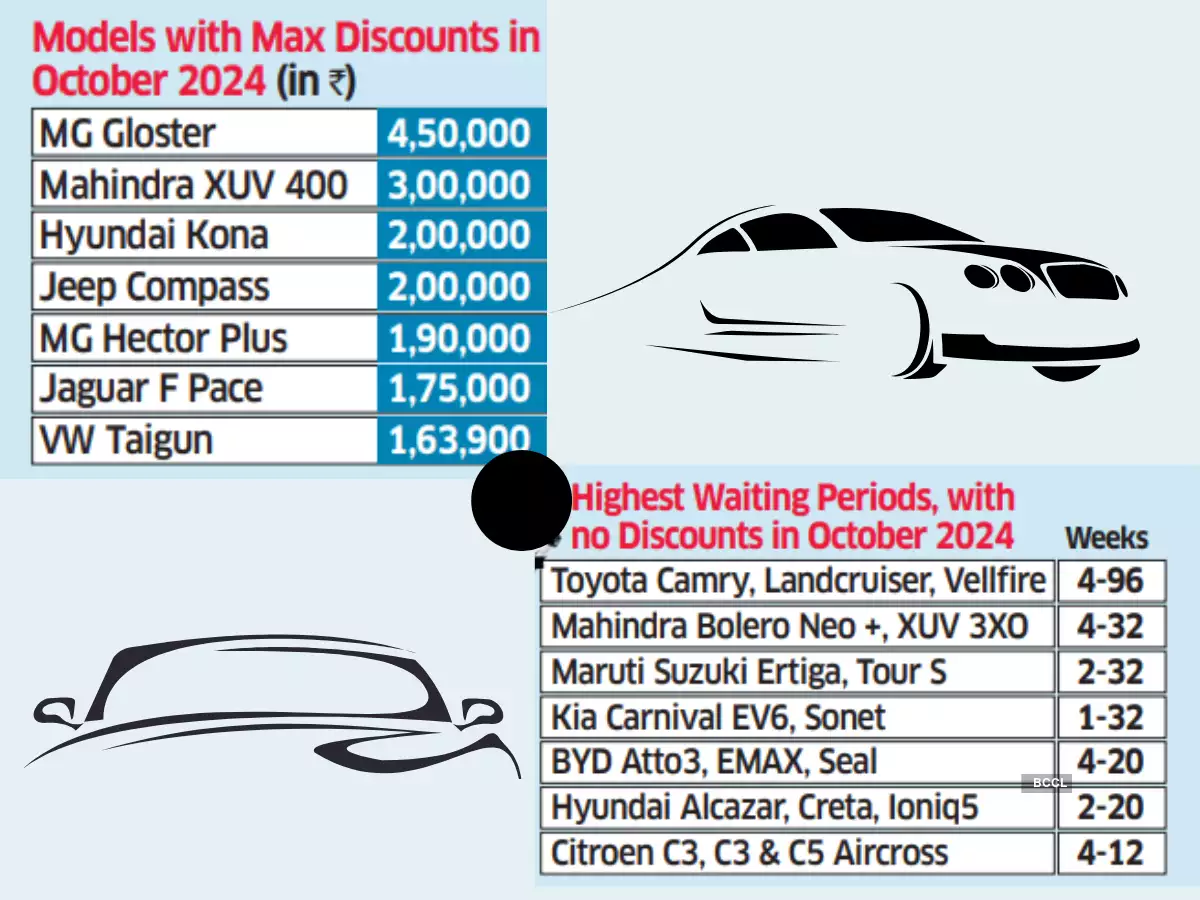

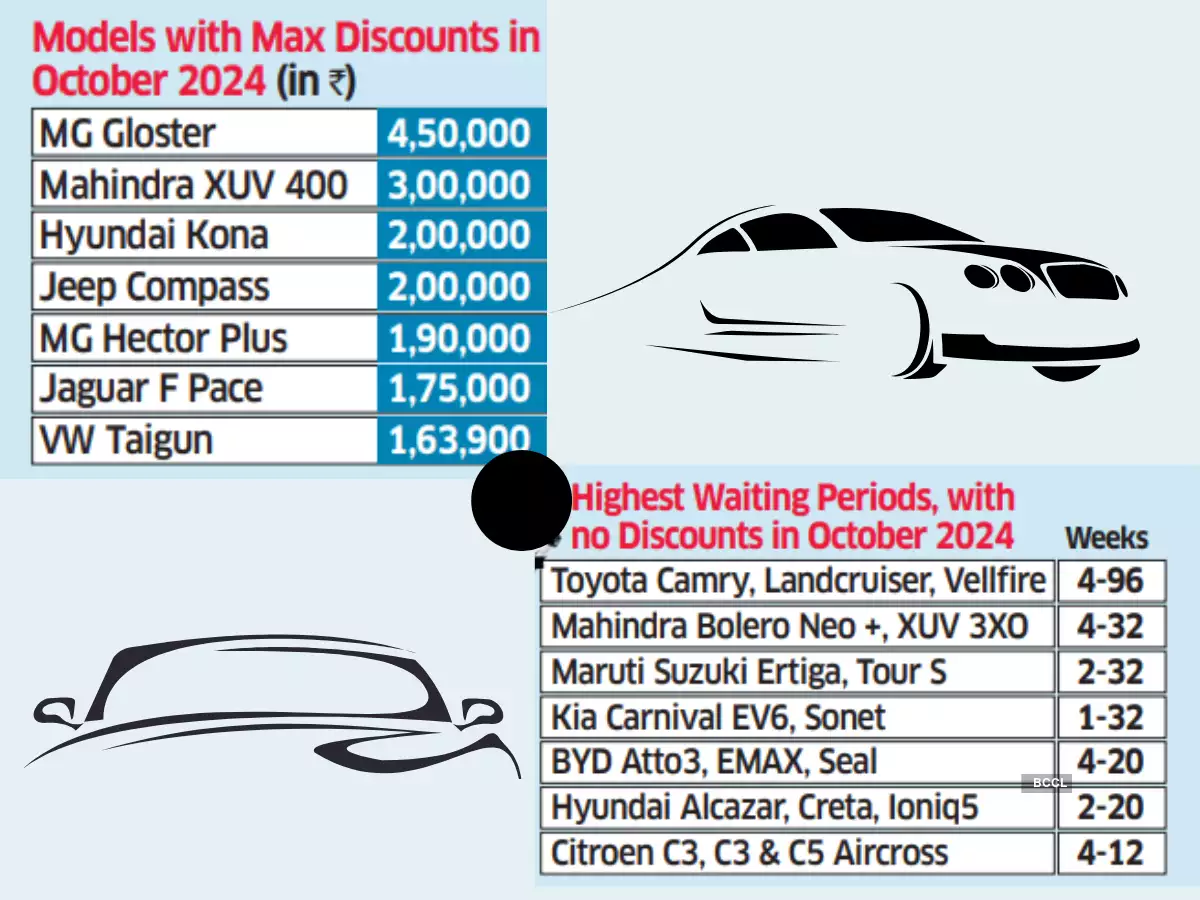

Several mainstream manufacturers are offering substantial discounts on select models to stimulate sales while Toyota's Land Cruiser leads the waiting period chart at 96 weeks, according to data collated by Jato Dynamics.

MG leads the discount wave with up to INR 450,000 off on its Gloster SUV, followed by Mahindra's XUV400 and Hyundai's Kona with discounts of INR 300,000 and INR 200,000. At the same time, several electric vehicles and premium SUVs from manufacturers like BYD and Hyundai continue to see waiting periods ranging from 4 to 32 weeks.

"This sustained demand for premium vehicles comes despite minimal discounting, suggesting a resilient luxury segment unfazed by broader market pressures," said Ravi Bhatia, president of Jato Dynamics.

This also reflects a supply-demand mismatch.

Premium segments, particularly SUVs and EVs, continue to face supply constraints while maintaining a strong demand while the mass market segments are seeing increasing price sensitivity, necessitating hefty discounts to move inventory, dealers said.

Meanwhile, registration of passenger vehicles - a proxy for retail sales - have crossed 371,000 units so far this month, according to the government's Vahan portal.

Extending Incentives

PV retail sales (light motor vehicles and light passenger vehicles), as per Vahan, stood at 343,310 units in September.

Auto dealers are hopeful that their sales will cross the 400,000 mark this month and may extend their month-end incentives by 3-4 days to capitalise on Diwali and Dhanteras demand next week. The proposed extension of month-end sales incentives suggests dealers are optimistic about converting festive sentiment into sales, which may not be as buoyant as the last two years but not a washout either.

Passenger vehicle sales in India are driven by the seasonality of festivals. “The sales went up in September but then they were offset by the Shraddh period. The festive and marriage season in October and November is expected to see an uptick in demand,” a leading Delhi-based car dealer said, requesting anonymity. Another dealer said the inventory levels continue to be high. With flat sales of PVs in the first half of 2024-25, the industry is expecting a rebound in the second half, powered by the festival season. The PV industry is expected to post a growth of “sub 5%” in FY2025, Shailesh Chandra, president of the Society of Indian Automobile Manufacturers (Siam), said recently. Experts said car buyers’ response to the current situation of waitlists versus discounts will likely shape manufacturer approaches to the Indian market in coming quarters.