Research suggests that over 25% of people in Bengaluru use two-wheelers for their commute, of which we estimate at least 5 lakh two-wheelers travelling to IT offices daily.

Research suggests that over 25% of people in Bengaluru use two-wheelers for their commute, of which we estimate at least 5 lakh two-wheelers travelling to IT offices daily. Most people in India travel less than 50 km daily on their two-wheelers. We conducted a market survey that revealed that most of the popular electric two-wheelers (E2Ws) sold today have a real-world range of at least 55 km. So why don’t we see more E2Ws on the road?

While there are reasons such as cost and battery life, concerns about charging infrastructure were glaringly evident in our survey. In urban settings, most people live in buildings with limited access to safe parking spaces or restrictions on installing charging sockets and infrastructure. Meanwhile, standalone public charging stations are not popular because of high land costs, equipment costs, and low revenue incurred by charge point operators.

Research suggests that over 25% of people in Bengaluru use two-wheelers for their commute, of which we estimate at least 5 lakh two-wheelers travelling to IT offices daily. These two-wheelers spend about 8 hours in the parking lot of an office building. Considering most E2Ws take only 6 hours or less to fully charge using their portable chargers, could these parking spaces help make the most of the idle time?

Yes! Such offices could easily provide simple and robust three-pin slow-charging sockets in the parking to address the charging concerns of their employees. Even if this facility is provided at a certain cost, workplace charging will still be cheaper than public charging because land cost is eliminated in this case. Having charged their E2Ws in the office, most commuters will have sufficient juice in their vehicles to travel home and return to the office the following day. This could create a massive incentive for the 5 lakh two-wheeler owners in Bengaluru to switch to electric!

If implemented nationally across the eight major Tier 1 cities, this idea could prompt 35–70 lakh vehicle owners to switch to electric vehicles (EVs). To further the cause, if the installation cost of a charging socket with the associated digital infrastructure is subsidised by 50%, the budget will be around INR 125 crore per city and about INR 1,000 crore at the national level. This expenditure could have a threefold impact on the economics of EV transition.

Primary impact: The cost of this proposed subsidy will be under 10% of the total budget outlay of the Prime Minister Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) scheme and under 11% of the National Clean Air Programme (NCAP) budget. While vehicle subsidies result in a one-time transition of a vehicle to an EV, subsidies on chargers have a lasting impact. They not only cover installation costs but also encourage broader EV adoption over time.

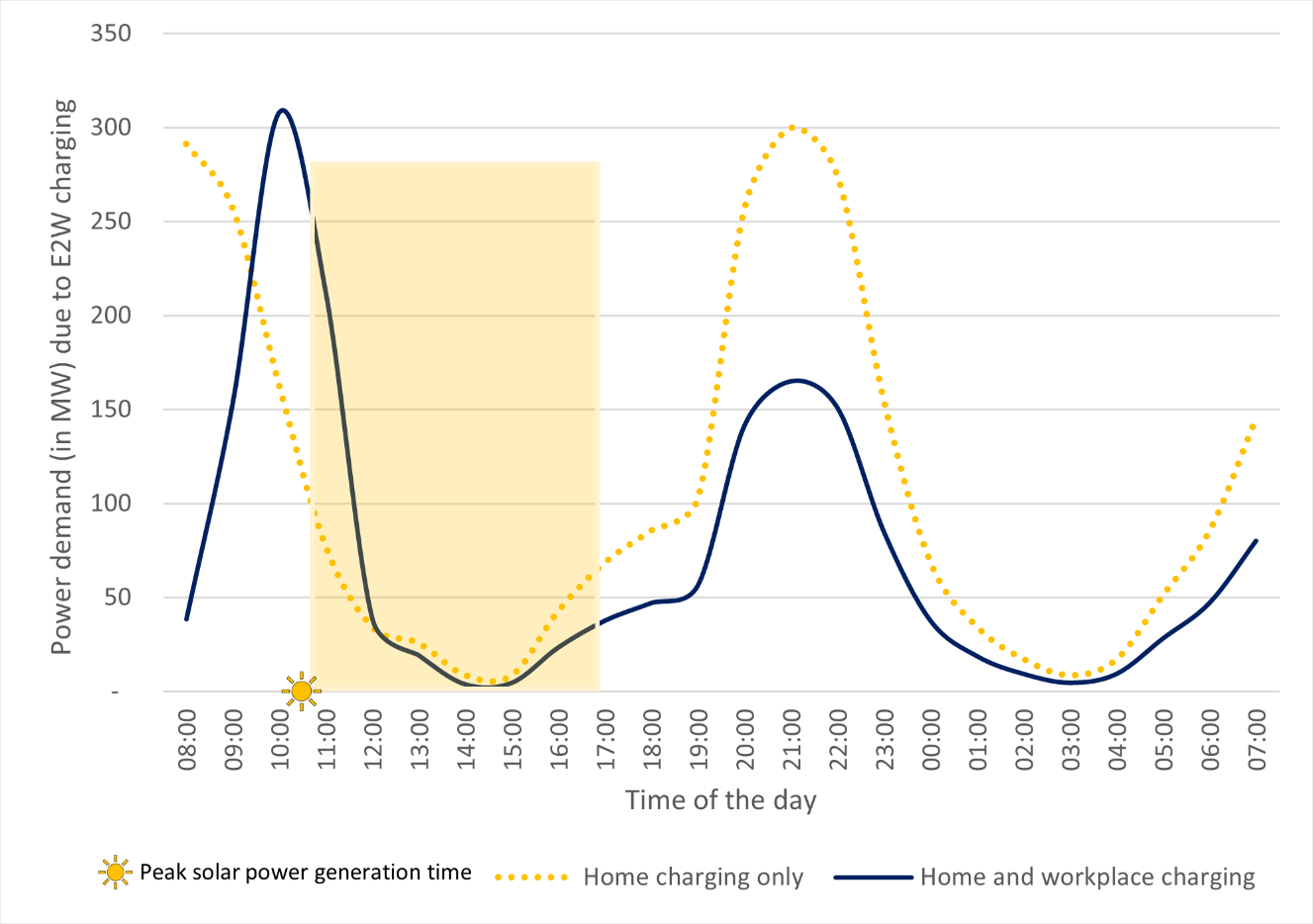

Secondary impact: Relying solely on home charging for EVs causes peak grid power demand to spike in the evening when everyone plugs in their vehicles for charging after work. Often, this load is met by non-renewable energy sources. Incorporating workplace charging could shift some demand to daytime, significantly reducing evening peaks and aligning with peak solar production hours (Image 1).

Image 1. Electric two-wheeler power demand: Home vs Home and workplace charging scenarios in Bengaluru (2030)

Image 1. Electric two-wheeler power demand: Home vs Home and workplace charging scenarios in Bengaluru (2030)As this practice grows, it will prepare cities and EV owners for the advent of Vehicle-to-Grid (V2G) technology. V2G is a technology that lets electric cars send power back to the grid when needed. Owners can charge their cars with cheap renewable energy and sell the power back at higher prices during peak demand. This can help maximise renewable energy use and allow car owners to profit from energy trading.

Tertiary impact: Office building managers have a potential opportunity to generate extra income by converting unoccupied parking spaces and charging spots for overnight charging. The availability of secure overnight parking spaces with charging amenities might motivate nearby residents to switch to EVs, possibly even doubling the E2W adoption.

A PwC analysis shows that workplace charging is the fastest-growing charging segment in the US. About 55% of people in India have no access to home charging, according to a McKinsey survey conducted in 2023. A dedicated policy push in India with awareness programmes, provision of the abovementioned subsidy and other incentives, and relevant regulation can pique the interest in workplace charging to make it lucrative for all stakeholders.

Besides, technological developments will soon ensure that batteries charge in 15 minutes, regardless of their size. Naturally, public charging operators might favour cars that can buy 10 times more energy than E2Ws in the same 15 minutes. This could reduce the charging infrastructure for E2Ws, making the case for alternatives like workplace charging.

In short, implementing a robust workplace charging infrastructure for E2Ws in Tier 1 cities can significantly boost EV adoption, reduce peak power demand, and create new revenue streams, making it a cost-effective and sustainable solution for India’s transition to electric mobility.

(Disclaimer: Ankith Hebbar P is a Senior Analyst in the Green Mobility team and Thirumalai N C heads the Strategic Studies team at the Center for Study of Science, Technology and Policy, a research-based think tank. Views are personal.)

To learn more about the electric vehicle ecosystem and meet the key industry leaders, click here.