For minerals like lithium oxide and nickel oxide, the dependency is low on one country, but overall imports largely come from Russia and China, both countries with potential trade risks, it said.

For minerals like lithium oxide and nickel oxide, the dependency is low on one country, but overall imports largely come from Russia and China, both countries with potential trade risks, it said.India’s import dependency for critical minerals will continue as their demand is expected to more than double by 2030, with domestic mines taking more than a decade to start operations, according to a new report by the Institute for Energy Economics and Financial Analysis (IEEFA).

It said that the country needs to carefully craft its import strategy to circumvent potential trade risks while balancing international ties for procuring minerals critical to accelerating its energy transition.

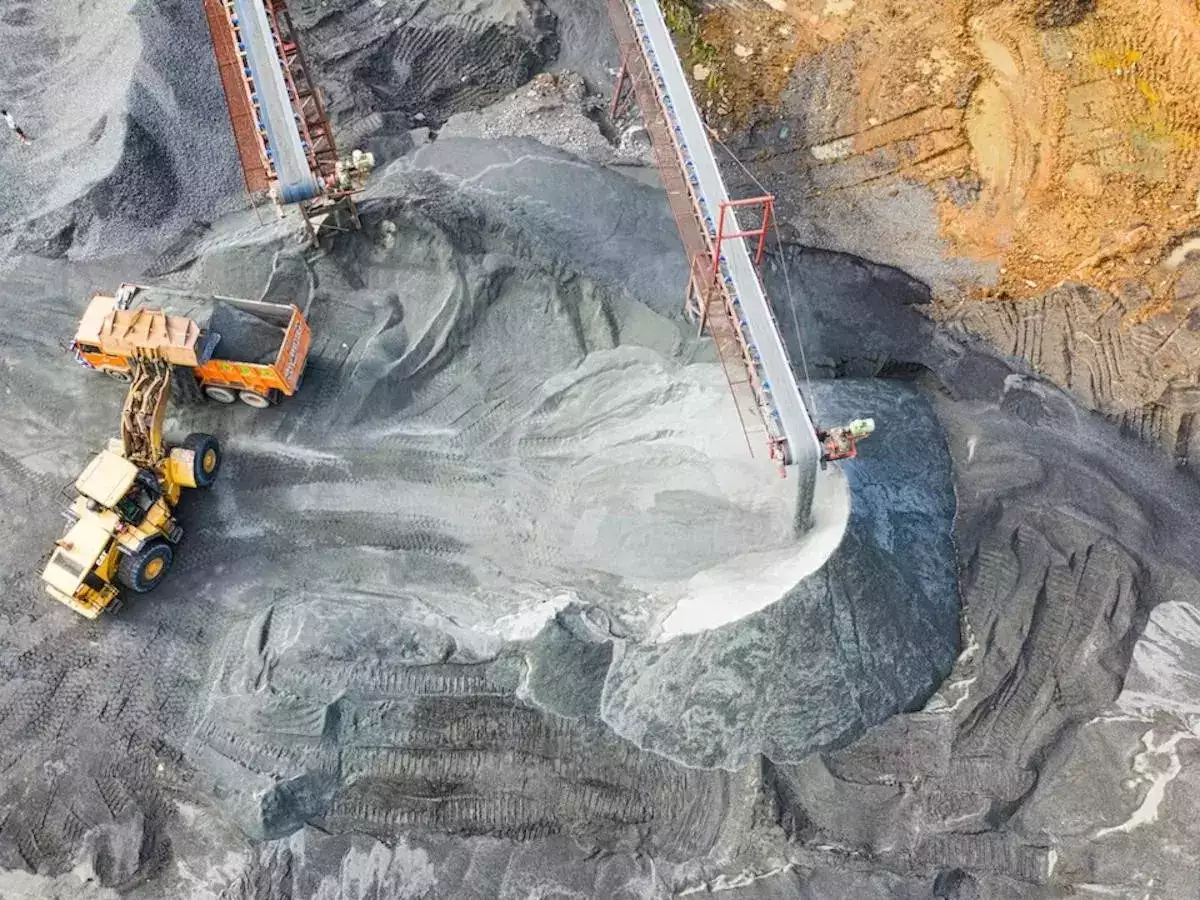

According to the report, the demand for critical minerals is expected to more than double by 2030, while domestic mines will take more than a decade to start producing.

The report examines five critical minerals – cobalt, copper, graphite, lithium and nickel – from the perspective of import dependency, trade dynamics, domestic availability and global price fluctuations.

It noted that India remains largely dependent on imports for these minerals and their compounds, with 100 per cent import dependency for minerals like lithium, cobalt and nickel.

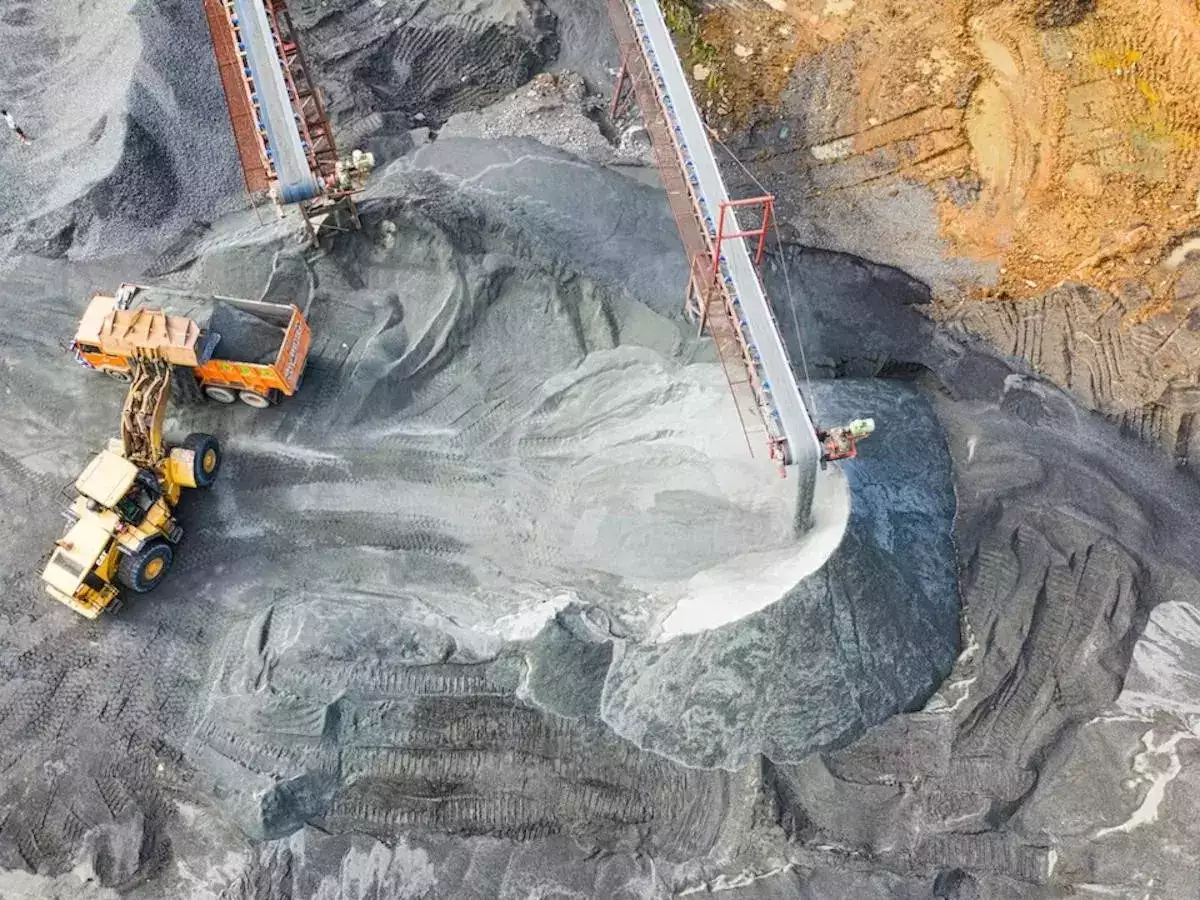

“India should strive to de-risk its critical minerals sourcing by identifying new international resources and expediting domestic production. A concerted effort to partner with and foster bilateral relations with mineral-rich nations should be a priority for India,” said Charith Konda, Energy Specialist, IEEFA, and the report’s co-author.

He added that the country can also explore investment opportunities in resource-rich, friendly nations, such as Australia and Chile, as well as African countries like Ghana and South Africa.

Regarding specific minerals, the report identifies synthetic graphite and natural graphite as ones that need a policy intervention to diversify procurement sources.

“For both variants of graphite, India depends heavily on China. Mozambique, Madagascar, Brazil, and Tanzania are some countries with the highest graphite production. As part of the Global South cooperation initiatives, these countries could be favourable partners for India for graphite trading,” said Kaira Rakheja, Energy Analyst, IEEFA, and the report’s co-author.

It added that India is also highly import-dependent for copper cathodes and nickel sulphates, from just two countries – Japan and Belgium. It suggested that India could look at the US, the fifth-largest producer of copper in the world, to diversify its suppliers and enhance supply security.

For minerals like lithium oxide and nickel oxide, the dependency is low on one country, but overall imports largely come from Russia and China, both countries with potential trade risks, it said.

“Developing domestic lithium refining capacity will help India integrate with the global lithium supply chain,” said Rakheja.

Konda added that government support in the form of viability gap funding and technology development will help promote such auctions and ultimately the domestic production of critical minerals. A stable supply of critical minerals is imperative for India to achieve its renewable energy goals.